In today’s fast-paced financial markets, having the right tools to analyze data and make informed decisions is crucial for investors aiming to maximize their portfolio growth. BigCharts is a powerful tool offering comprehensive features designed to enhance financial analysis and decision-making processes. Whether you’re a beginner exploring the basics of stock charting or a seasoned investor looking to refine your trading strategies, understanding the key features of BigCharts can significantly elevate your investment game.

Table: Comparison of Technical Indicators Supported by BigCharts

| Technical Indicator | Description | Use Case |

| Moving Averages | Smooths out price data to identify trends | Trend identification, support/resistance |

| Relative Strength Index | Measures momentum of price movements | Overbought/oversold conditions |

| MACD (Moving Average Convergence Divergence) | Shows relationship between two moving averages | Trend changes, buy/sell signals |

| Bollinger Bands | Measures volatility and price levels | Volatility analysis, potential breakout points |

What is BigCharts?

Definition and Purpose

BigCharts is a robust online charting platform widely used by investors to visualize and analyze financial data. It provides users with customizable charts, technical analysis tools, access to historical data, comparison features, and real-time market updates—all essential components for making informed investment decisions.

Importance of Visualizing Data

The ability to visualize data effectively is fundamental in financial analysis. BigCharts simplifies complex market information into easily interpretable charts, helping investors identify trends, patterns, and potential opportunities or risks within the market.

Key Features of BigCharts

Customizable Charting Tools

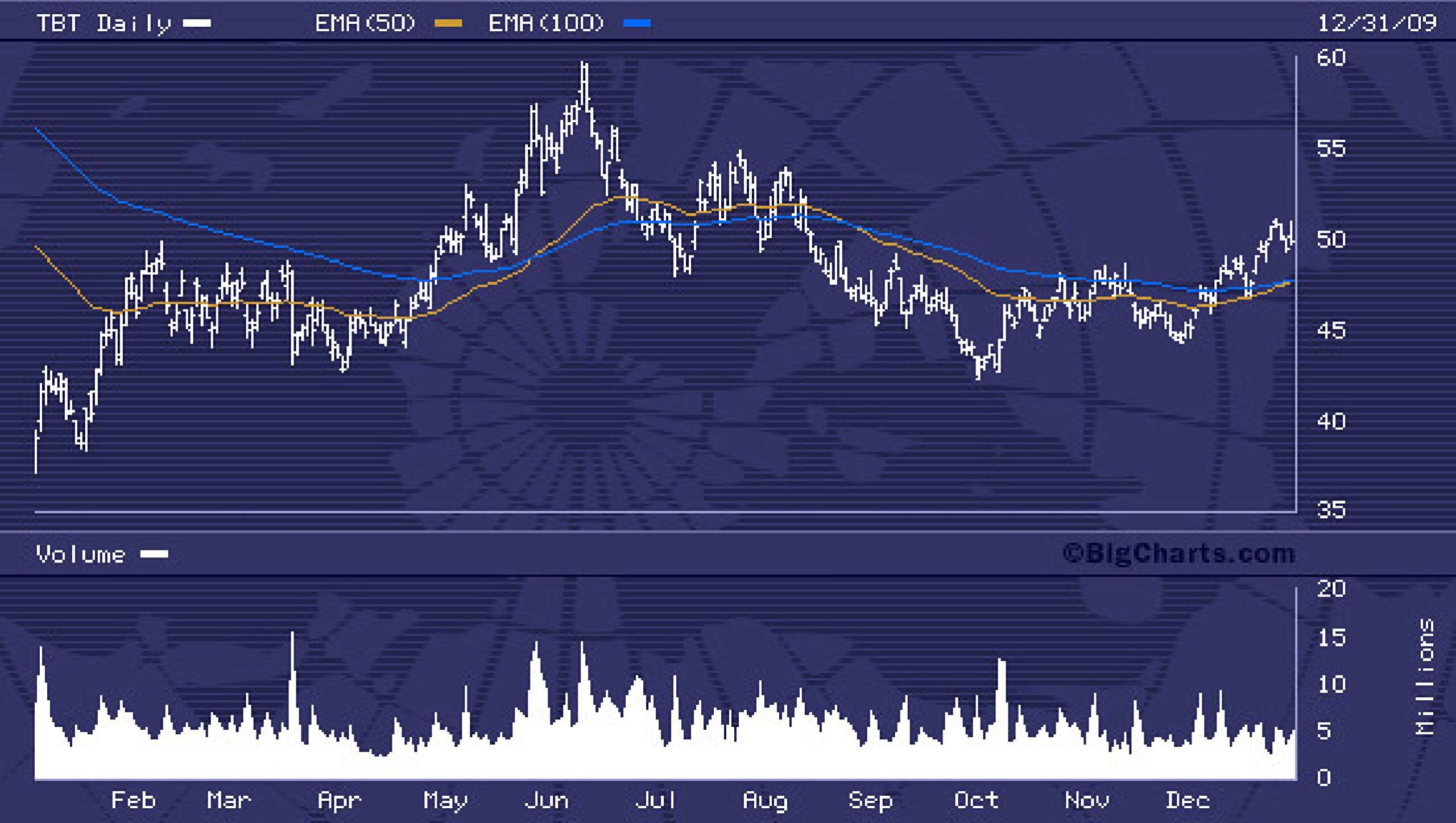

One of the standout features of BigCharts is its customizable charting tools. Investors can tailor charts according to their specific needs and preferences. Whether you’re tracking individual stocks, market indices, or commodities, BigCharts offers a user-friendly interface that allows you to adjust parameters such as time frames, chart types (line, bar, candlestick), and overlay indicators.

Customization is crucial because it enables investors to focus on the metrics that matter most to their investment strategy. For instance, day traders may prefer intraday charts with minute-by-minute data, while long-term investors might utilize weekly or monthly charts to capture broader trends. By customizing charts on BigCharts, investors gain deeper insights into price movements, volume patterns, and technical signals that guide their buying or selling decisions.

Technical Analysis Tools

Technical analysis plays a pivotal role in understanding market behavior and predicting future price movements. BigCharts supports a wide range of technical indicators, including moving averages, Relative Strength Index (RSI), MACD (Moving Average Convergence Divergence), and Bollinger Bands, among others.

These tools empower investors to conduct detailed analyses of stock trends and momentum, identify support and resistance levels, and spot potential entry or exit points for trades. For example, using Bollinger Bands on BigCharts helps traders visualize volatility and price fluctuations, aiding in decision-making processes that align with their risk tolerance and investment goals.

Historical Data Access

Access to historical data is essential for conducting thorough market analysis and making informed investment decisions. BigCharts provides users with extensive historical price data spanning several years, allowing them to analyze past trends, performance metrics, and seasonal patterns.

Investors can use historical data on BigCharts to backtest trading strategies, evaluate the effectiveness of investment decisions over time, and identify recurring market cycles. For instance, analyzing historical price movements using moving averages on BigCharts can help investors identify long-term trends and potential trend reversals, informing strategic portfolio adjustments and asset allocation decisions.

Comparison Tools

Comparative analysis is a powerful feature offered by BigCharts, enabling investors to compare multiple securities or market indices side by side. This feature is particularly valuable for evaluating relative performance, identifying sector trends, and making data-driven investment choices.

On BigCharts, users can easily overlay different stocks or indices on the same chart, allowing for direct visual comparison of price movements, volume trends, and relative strength. For example, comparing the performance of tech stocks against the broader market index can reveal sector-specific insights and potential investment opportunities that align with current market conditions.

Real-Time Market Data

Timely information is critical in dynamic financial markets, and BigCharts delivers real-time market data updates to keep investors informed of the latest developments. Whether you’re monitoring stock prices, tracking global indices, or staying updated on economic news, BigCharts ensures you have access to up-to-the-minute data that influences market sentiment and trading decisions.

Real-time data on BigCharts enables investors to react swiftly to market events, capitalize on emerging opportunities, and manage portfolio risk effectively. For instance, active traders can set real-time alerts on BigCharts to notify them of significant price movements or technical signals, enabling timely adjustments to their trading strategies based on current market conditions.

Using BigCharts to Improve Your Portfolio

Case Studies and Examples

To illustrate the practical application of BigCharts, consider the following case studies where investors have leveraged its features to achieve significant portfolio improvements:

- Case Study 1: Timing Entry and Exit Points

- Scenario: A swing trader uses BigCharts’ customizable charting tools to analyze technical indicators such as moving averages and RSI.

- Outcome: By identifying oversold conditions on a stock using BigCharts’ technical analysis features, the trader strategically enters a position at a favorable price point. Subsequently, using real-time data updates, they exit the trade as the stock reaches overbought levels, locking in profits.

- Case Study 2: Sector Rotation Strategy

- Scenario: An investor employs BigCharts’ comparison tools to compare the performance of various sectors within the market.

- Outcome: By identifying sectors showing relative strength and positive momentum using comparative analysis on BigCharts, the investor reallocates their portfolio to overweight sectors poised for growth. This strategic sector rotation strategy enhances portfolio diversification and capitalizes on sector-specific opportunities.

Tips and Best Practices

Whether you’re new to BigCharts or looking to refine your usage, consider these tips and best practices to maximize its benefits:

- Start with the Basics: Begin by familiarizing yourself with BigCharts’ basic features, such as setting up customizable charts and exploring different chart types.

- Utilize Technical Indicators: Experiment with various technical indicators available on BigCharts to enhance your understanding of price movements and market trends.

- Set Alerts and Notifications: Take advantage of BigCharts’ alert features to stay informed about significant price changes, volume spikes, or technical signals that align with your trading strategy.

- Combine Fundamental and Technical Analysis: Integrate fundamental analysis metrics with technical indicators on BigCharts to gain a comprehensive view of a stock’s potential value and growth prospects.

- Stay Updated with Real-Time Data: Regularly monitor real-time market data updates on BigCharts to make timely decisions based on current market conditions and news events Read More Blogs Here Spry Stock.

Conclusion

In conclusion, BigCharts stands as a powerful toolset for investors seeking to enhance their portfolio management strategies and make informed investment decisions. By leveraging its customizable charting tools, comprehensive technical analysis capabilities, access to historical data, comparison features, and real-time market updates, investors can gain valuable insights into market trends, identify profitable opportunities, and optimize their investment portfolios for long-term success.

Whether you’re a day trader focused on intraday price movements or a long-term investor planning strategic asset allocation, integrating BigCharts into your investment toolkit empowers you with the tools and knowledge needed to navigate today’s dynamic financial markets with confidence and clarity. Embrace the features of BigCharts, explore its capabilities, and embark on a journey toward achieving your investment goals effectively.

FAQs (Frequently Asked Questions) about BigCharts

What is BigCharts used for?

BigCharts is primarily used for visualizing and analyzing financial data. It provides customizable charts, technical analysis tools, historical data access, comparison features, and real-time market updates to help investors make informed decisions.

How can BigCharts help improve my portfolio?

BigCharts can improve your portfolio by offering insights into market trends, identifying potential investment opportunities, and facilitating strategic decision-making through its robust features like customizable charting tools, technical indicators, and historical data analysis.

Is BigCharts suitable for beginner investors?

Yes, BigCharts is suitable for beginners as well as experienced investors. It offers user-friendly interfaces, basic charting tools, and educational resources to help beginners understand market analysis concepts and enhance their investment knowledge.

Can I access real-time data on BigCharts?

Yes, BigCharts provides real-time market data updates, including stock prices, indices, and economic news. This real-time information helps investors stay updated on market movements and make timely investment decisions.

How do I use BigCharts for technical analysis?

BigCharts supports various technical indicators such as moving averages, RSI, MACD, and Bollinger Bands. Users can apply these indicators to charts to analyze price trends, momentum, and potential entry or exit points for trades.

Does BigCharts offer mobile compatibility?

Yes, BigCharts offers mobile-friendly versions and apps, allowing users to access their charts and market data on smartphones and tablets, making it convenient for investors to stay connected and manage their portfolios on the go.